論文情報

著者:R. Wu, H. Dai, Y. Geng, Y. Xie, T. Masui, and X. Tian.

掲載年:2016

雑誌名:Applied Energy (In press)

◆論文へのリンク

キーワード

Carbon cap-and-trade (ETS); Computable general equilibrium model; Shanghai

概要

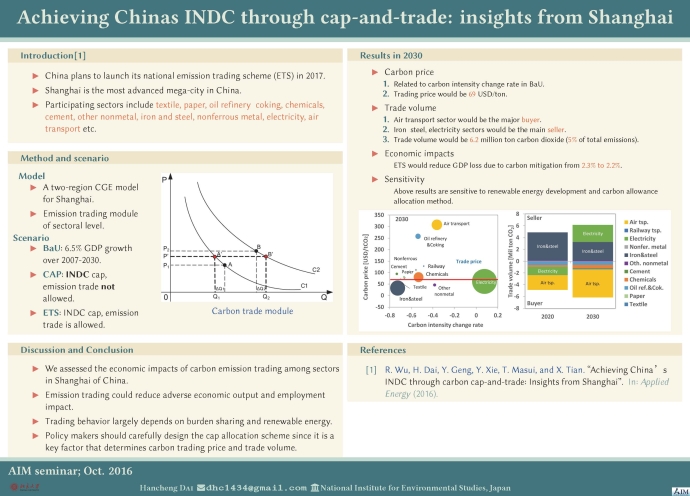

Emission trading scheme (ETS) is considered as a cost-effective way to cut emissions. This study evaluates the economic impacts of ETS policy by using a static computable general equilibrium (CGE) model in Shanghai, one of China’s seven ETS pilots. Three scenarios are set considering the target of Intended Nationally Determined Contributions (INDC) by 2030, including a reference scenario, carbon cap without ETS scenario and with ETS scenario. This study shows that ETS would reduce GDP loss due to carbon mitigation from 1.3% to 1.1% relative to baseline level in 2020 and 2.3% to 2.2% in 2030. The trading carbon price in 2020 and 2030 would be 38 and 69 USD/ton and the trade volume would be 4.9 and 6.2 million ton carbon dioxide, respectively. Air transport sector would be the major buyer of emissions credit due to its comparatively higher carbon abatement cost whereas iron & steel, electricity sectors would be the main sellers. However, the above findings are sensitive to various policy arrangements such as renewable energy development and carbon allowance allocation method. This study concludes that carbon cap-and-trade could reduce adverse economic output and employment impact. Policy makers should carefully design the cap allocation scheme since it is a key factor that determines carbon trading price and trade volume.

*画像をクリックすると拡大されます